Deep Tech Venture Studios Are the Missing Investment Vehicle to Combat Climate Change

About Venture Studios

Before we talk about why deep tech and why climate, let us first explore why venture studios have exploded in recent years. Venture studios present a distinctive investment opportunity, distinguishing themselves from traditional venture capital firms by being deeply embedded as a cofounder in each business in which they invest. Venture studios come in different shapes and sizes. Transition State builds cofounding teams around early stage deep tech innovations, invests meaningful capital in a staged approach, and partners with each company as a de-facto cofounder with a 20 month program to rapidly develop the technology, go to market, team, and much more. Our approach leverages our experience incubating dozens of deep tech climate businesses in prior roles.

Unlike venture capital, which primarily addresses the need for capital, venture studios are a cofounder and usually the reason the company exists in the first place. And, unlike accelerators, venture studios are deeply involved with each company they create for a period of years as opposed to a few months, investing significant amounts of capital to get the company off the ground. This more involved approach helps de-risk and speed up each company they build.

Venture studios have become increasingly prevalent, with over $100B of enterprise value created from 800+ of them, generating successful companies like Snowflake, Dollar Shave Club, and Affirm.

Compelling Statistics Indicate Success

Despite being a newer asset class, venture studio startups have demonstrated remarkable accomplishments to date. These are some stats from the Global Startup Studio Network’s 2022 report:

84% of studio portfolio companies successfully raise a seed round.

Studio-formed companies boast a 30% higher success rate than traditional startups.

72% of venture studio startups advance to series A, compared to 42% of traditional ones.

The timeframe from founding to series A is less than half compared to traditional startups (25 months versus 56 months).

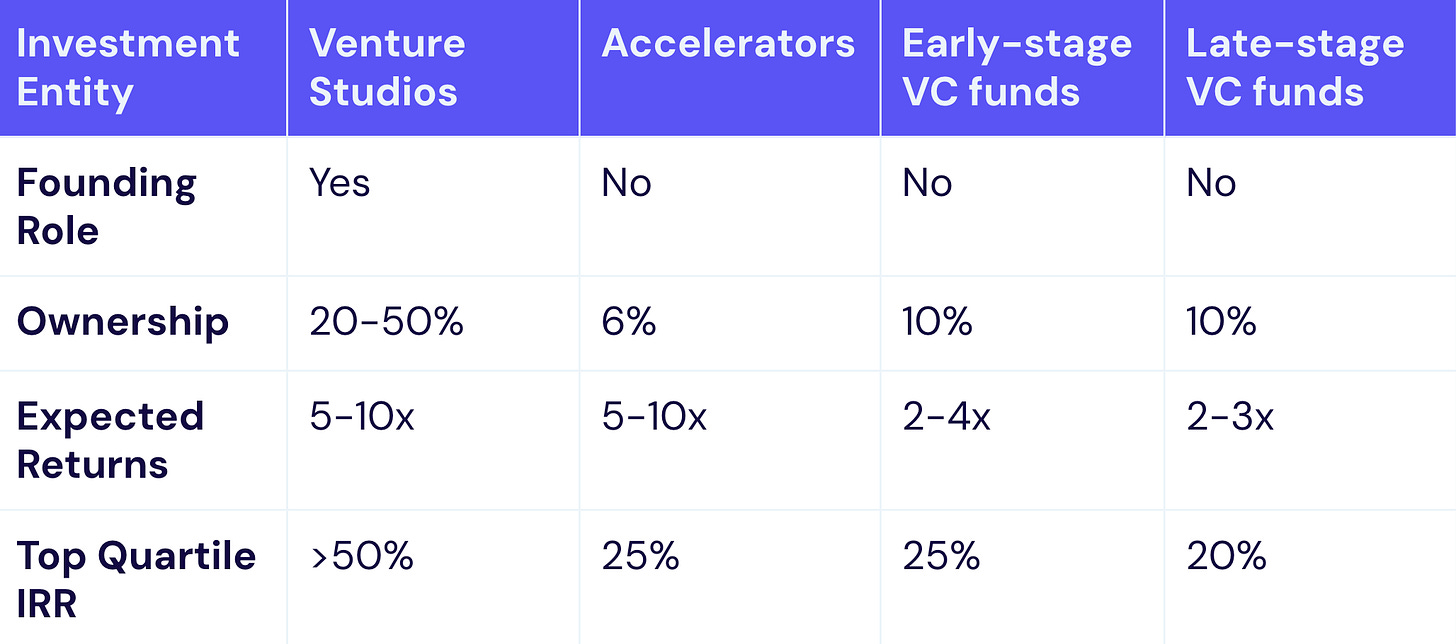

Additionally, the deeper involvement and meaningful equity ownership in the businesses that venture studios create has resulted in a stronger Internal Rate of Return (IRR) compared to even the top-performing VCs.

Based on Vault Fund's pipeline data. From the webinar State of the Venture Studio World, 2022.

Deep Tech Climate Venture Studios: Addressing a Critical Need

Now that we’ve established why venture studios are an exciting category, let us explore why deep tech climate venture studios are a very compelling area. Everyone has a different definition of deep tech. To us, it means that there are key patentable advancements in science or engineering at the core of each company we build. Currently, there are less than a few venture studios focused exclusively on the intersection of deep tech and climate. While there are many companies building software solutions within climate, climate change is largely a physical problem and requires physical solutions.

Meanwhile, the economic need is vast. 97 countries, which include the vast majority of the world’s wealth, have set net zero targets, and will be spending many trillions of dollars on this transition over the coming years. According to the IEA (International Energy Agency), nearly 50% of the technologies needed to realize these targets are still in the developmental stage, presenting a wealth of opportunities to build new deep tech climate businesses.

At the same time, there has been a surge in climate tech intellectual property.

There also has been a necessarily explosion in government funding. Just the Inflation Reduction Act alone allocates $369B to the green transition. Despite this, a significant gap remains in maturing these critical technologies in the lab and turning them into real businesses. This is where deep tech venture studios can play a pivotal role, acting as the missing critical component to significantly hasten the green transition by placing the cofounding team, providing substantial capital, and implementing a playbook to de-risk and accelerate each business.

One reason why deep tech venture studios have not tapped into this opportunity is because the creation of deep tech climate businesses demands specialized knowledge, such as expertise in chemistry, chemical engineering, and mechanical engineering, backgrounds rarely seen in venture capitalists.

Investing in Deep Tech Climate Venture Studios: An Opportune Moment

Why should investors consider putting their capital into a vehicle that creates deep tech climate businesses? Here’s why.

Government Grant Multiplier: we are targeting areas emphasized by the department of energy. We expect each company to acquire millions in potential grants. This means each dollar invested will likely be matched in equity-free grants. There are many other forms of non-dilutive financing, such as loans from the Department of Energy Loan Programs Office. That’s why despite a general belief that deep tech climate companies require substantial capital, they raise less private capital than software businesses due to availability from other non-dilutive sources.

Building deep tech climate businesses requires a playbook driven approach. There are very specific ways to rapidly develop and de-risk the technology, approach go-to-market, scaleup, etc. A venture studio with a strong background in creating these types of companies is well positioned to ensure that founders do not make costly mistakes.

50% of the most valuable tech companies in the world are hardware companies and 22% of the most most valuable companies in the world are software only companies, because the world needs physical things not just software.

It's a lot less competitive. While climate is a HOT area, there are too few companies in the deep tech side because highly specific expertise is required. Meanwhile, each company is built on intellectual property which is highly defensible.

Impact: Investing in a climate venture studio allows you to contribute directly to the development of the next generation of companies fighting climate change. The financial returns can be significant, but perhaps more importantly, your investment can be a driving force behind the existence of vital companies addressing this global challenge.

Do you want to help us make a difference? Please reach out.